🕳 Filling in Blackhole: Identifying Unsustainable Processes with SD #52

Replies: 1 comment 2 replies

-

|

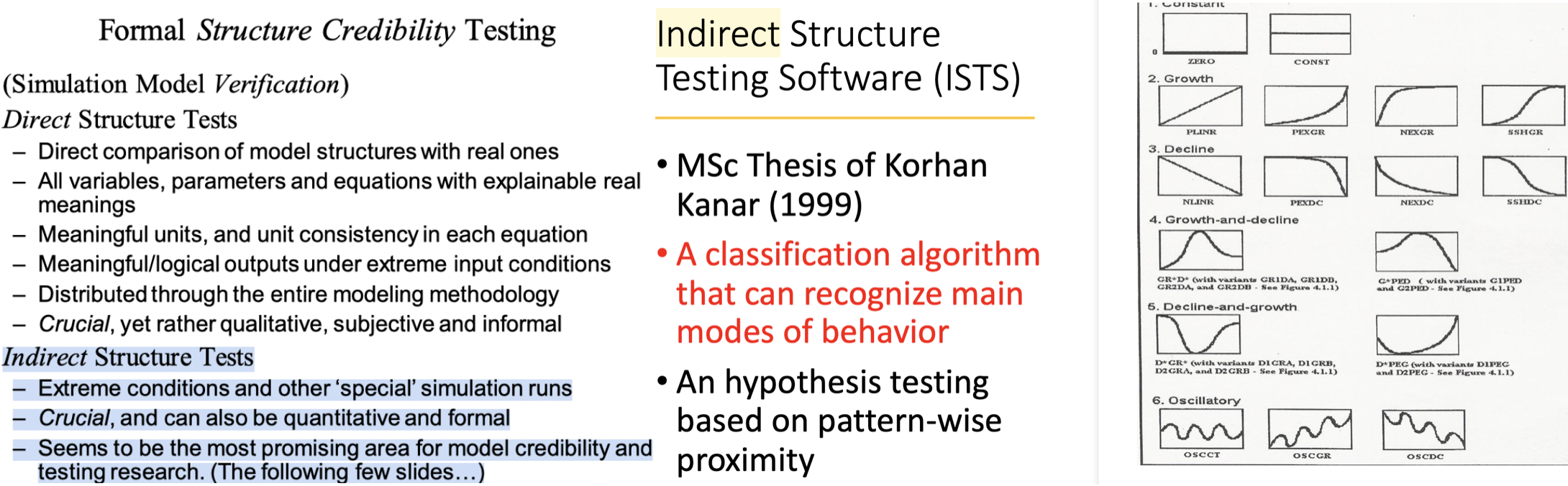

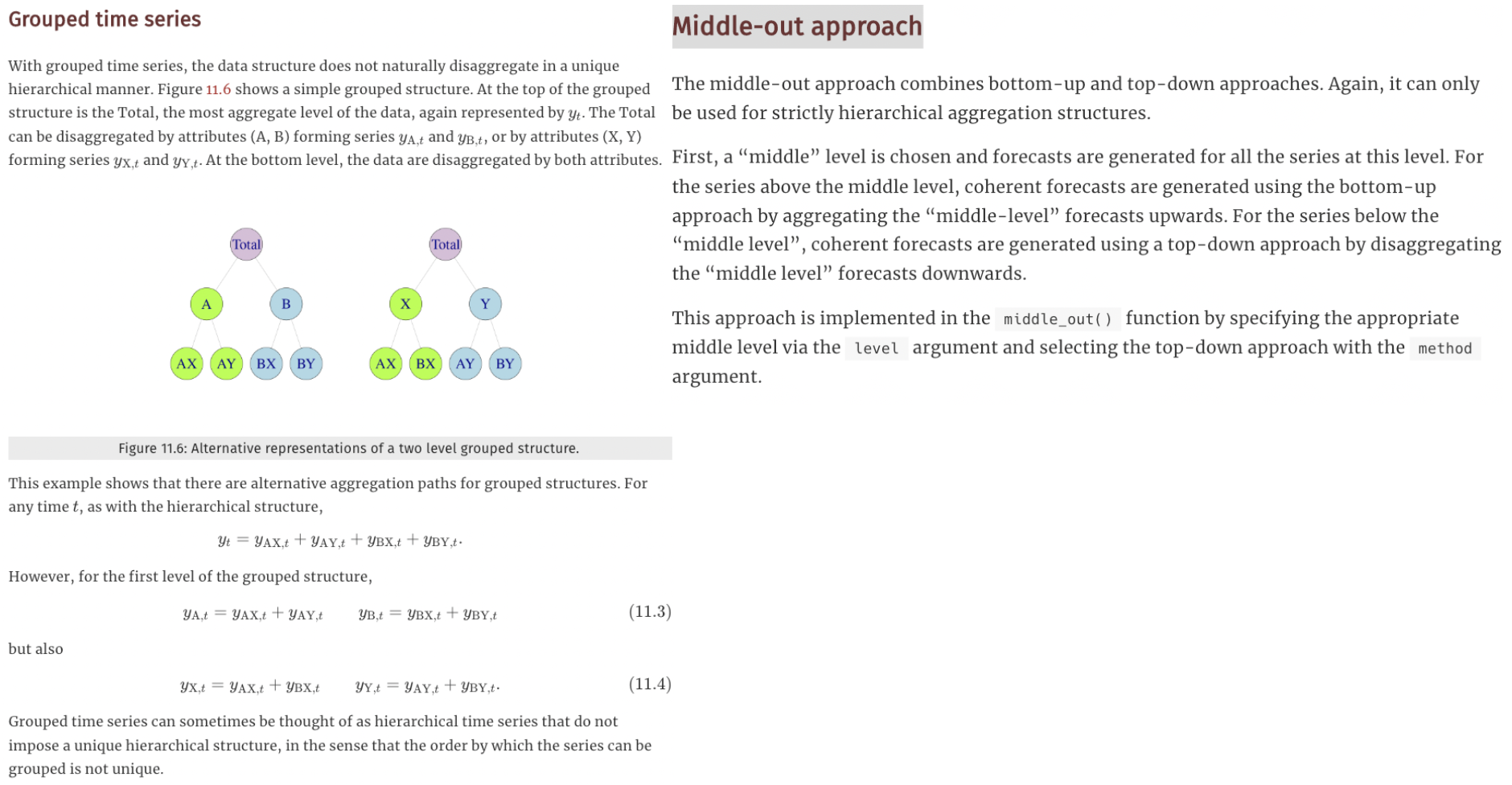

Q1. Which direction between disaggregation (compartment to agent-based) vs aggregation (agent-based to compartment) do you think is easier for testing indirect structure? Designing built-in internal consistency checks (e.g. Hazhir commented on Ali's presentation saying certain parameter vectors specified from sensitivity test are unreasonable) is hard but is important. If you were given the choice of model development direction, which would you choose between branching (disaggregating) vs merging (aggregating) and why? From Yaman's talk: Yaman's insightful comment from LTA talk (attached below): "The totality of relations (in real system or model) is called the structure (of real system or model)." Q2. This is relevant to our discussion on #32 and #34 in that hierarchical Bayesian model is middle-out approach starting from between compartment and agent-based modeling and can go either direction. Could we borrow mathematical formulation for middle-out approach in hierarchical time-series from below? Details here. Q3. Do we need internal consistency check along disaggregation? Or do we need to frame this as tradeoff between computation cost and accuracy? To be specific, is two compartment model always a special case of three compartment model? What internal consistency check do we additionally need when extending from S-I-R to S-E-I-R model? Tagging who might be able to help me out @zhasgul, @NzL94, @tomfid @jandraor @Dashadower Ref. |

Beta Was this translation helpful? Give feedback.

Uh oh!

There was an error while loading. Please reload this page.

-

Stock-flow consistent model

balance sheets are updated in any period, SFC models can be used to identify unsustainable processes, for example a prolonged deficit of a sector will result in an unsustainable stock of debt

consistent accounting framework prevents the modellers from leaving "black holes" i.e., unexplained parts of the model.

From Seven unsustainable process, Wynne Godley identified seven unsustainable processes in US below with the above Stock-flow consistent:

(1) the fall in private saving into ever deeper negative territory,

(2) the rise in the flow of net lending to the private sector,

(3) the rise in the growth rate of the real money stock,

(4) the rise in asset prices at a rate that far exceeds the growth of profits (or of GDP),

(5) the rise in the budget surplus,

(6) the rise in the current account deficit,

(7) the increase in the United States's net foreign indebtedness relative to GDP.

Beta Was this translation helpful? Give feedback.

All reactions